MMI Consumer Distress Dashboard

Throughout our financial counseling process, MMI collects numerous data points from our clients and their credit reports. This aggregated, anonymized information helps us understand the financial health of people contacting us for assistance and predict future trends.

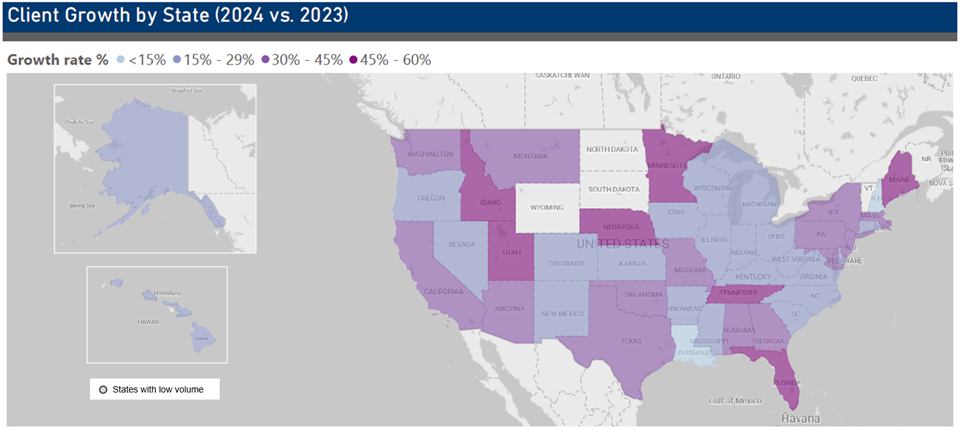

Our experts can provide context and offer deeper, state-level insights where disparity may exist on the local level.

Additionally, consumers counseled by MMI can discuss navigating financial challenges and how they successfully overcame them with the help of our debt management plan.

Over time, several themes have emerged:

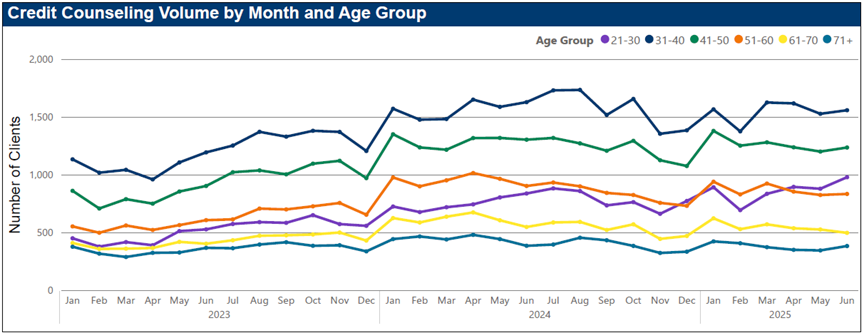

Young adults are struggling with debt

- We've seen a steady increase in the number of consumers seeking financial counseling over the last three years, particularly among younger adults.

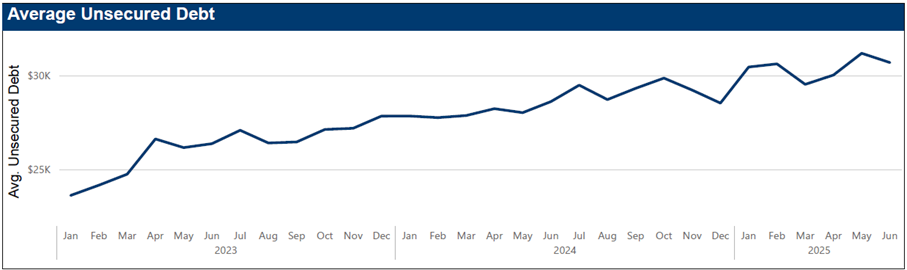

Personal debt continues to climb

- There's been consistent growth in the total level of unsecured debt our new clients carry at the time they contact MMI.

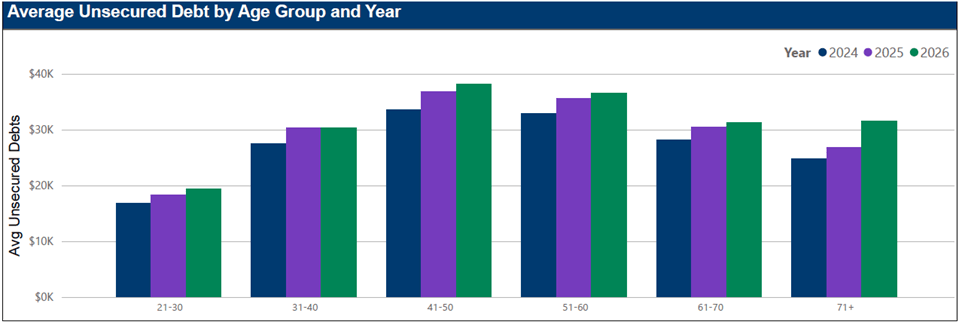

All age groups are impacted by rising debt levels

- With the exception consumers ages 31-40, all age groups continue to see sizable year-over-year increases in their debt levels.

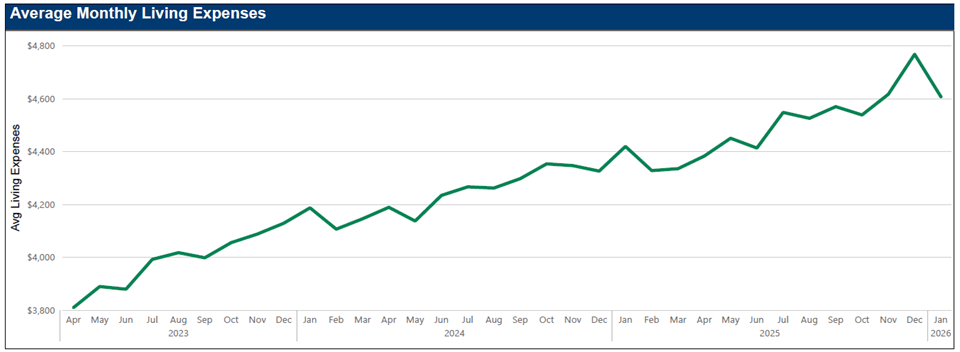

Household expenses are climbing rapidly

- With the exception of occasional season dips, household expenses are up consistently month-over-month.

Average debt loads vary widely by state

- Residents of Utah, Colorado, and Hawaii have consistently carried some of the largest debt burdens in recent years.