Setting Up Automated Deposits

You aren't required to set up automated deposits as part of your debt management plan, but it's far and away the most popular choice for DMP clients. Automated deposits let you "set it and forget it", which helps to ensure that you don't miss any future creditor payments while on the DMP.

Log In and open the ACH Deposit Signup page

Visit moneymanagement.org/login and use the username and password you created for yourself to log in to your MyMMI account.

Not able to use the direct link? You can reach the log in page from anywhere on MoneyManagement.org by clicking the "LOG IN" link in the upper right corner:

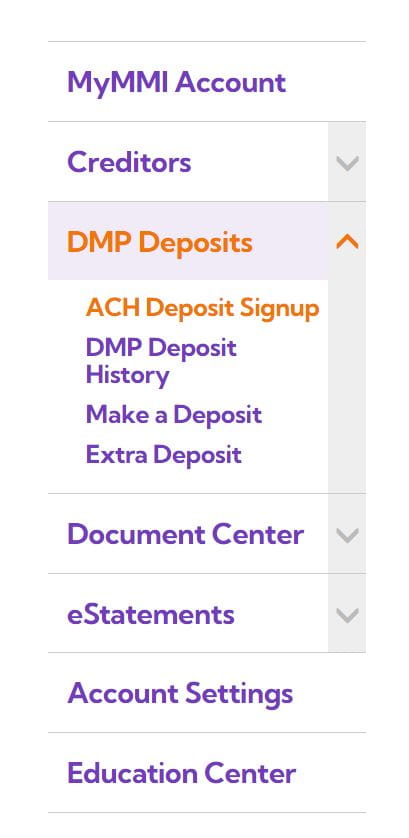

Open the DMP Deposit portion of the menu on the left side of the screen, then click "ACH Deposit Signup":

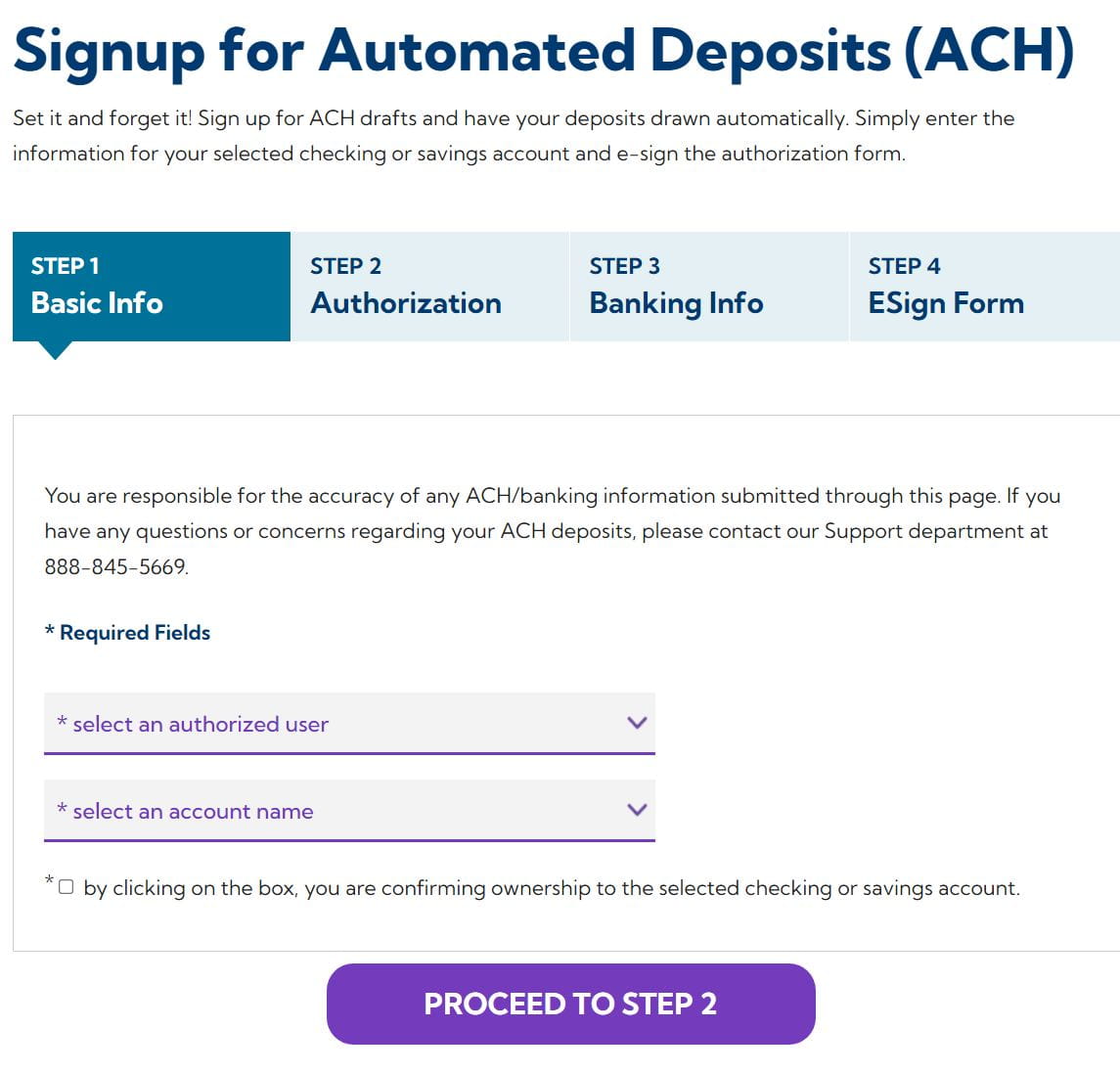

Step 1: Select the User and Account Type

- Select an authorized user

- Select an account name

- Click PROCEED TO STEP 2

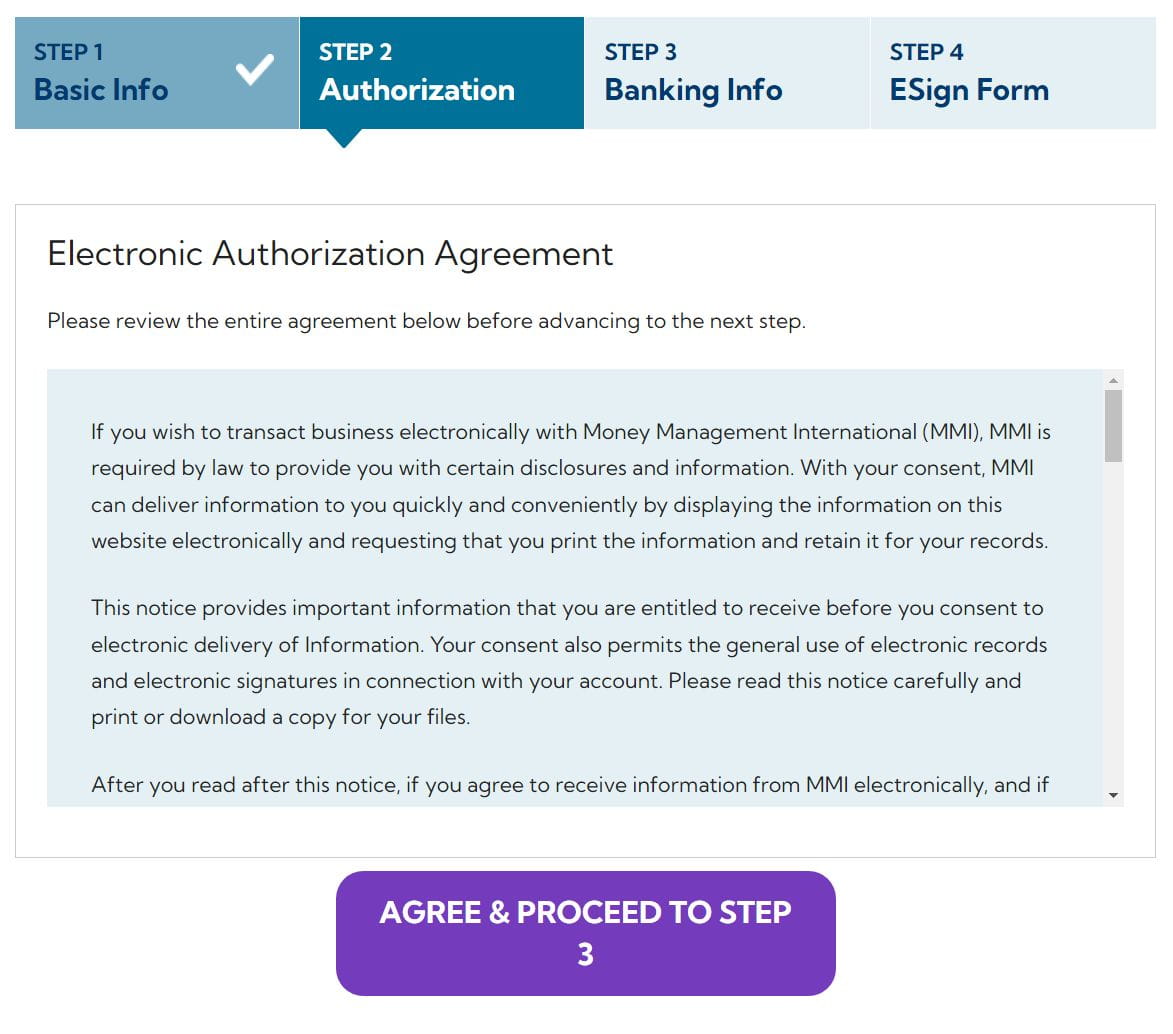

Step 2: Provide Authorization

- Review the authorization language

- Click AGREE AND PROCEED TO STEP 3

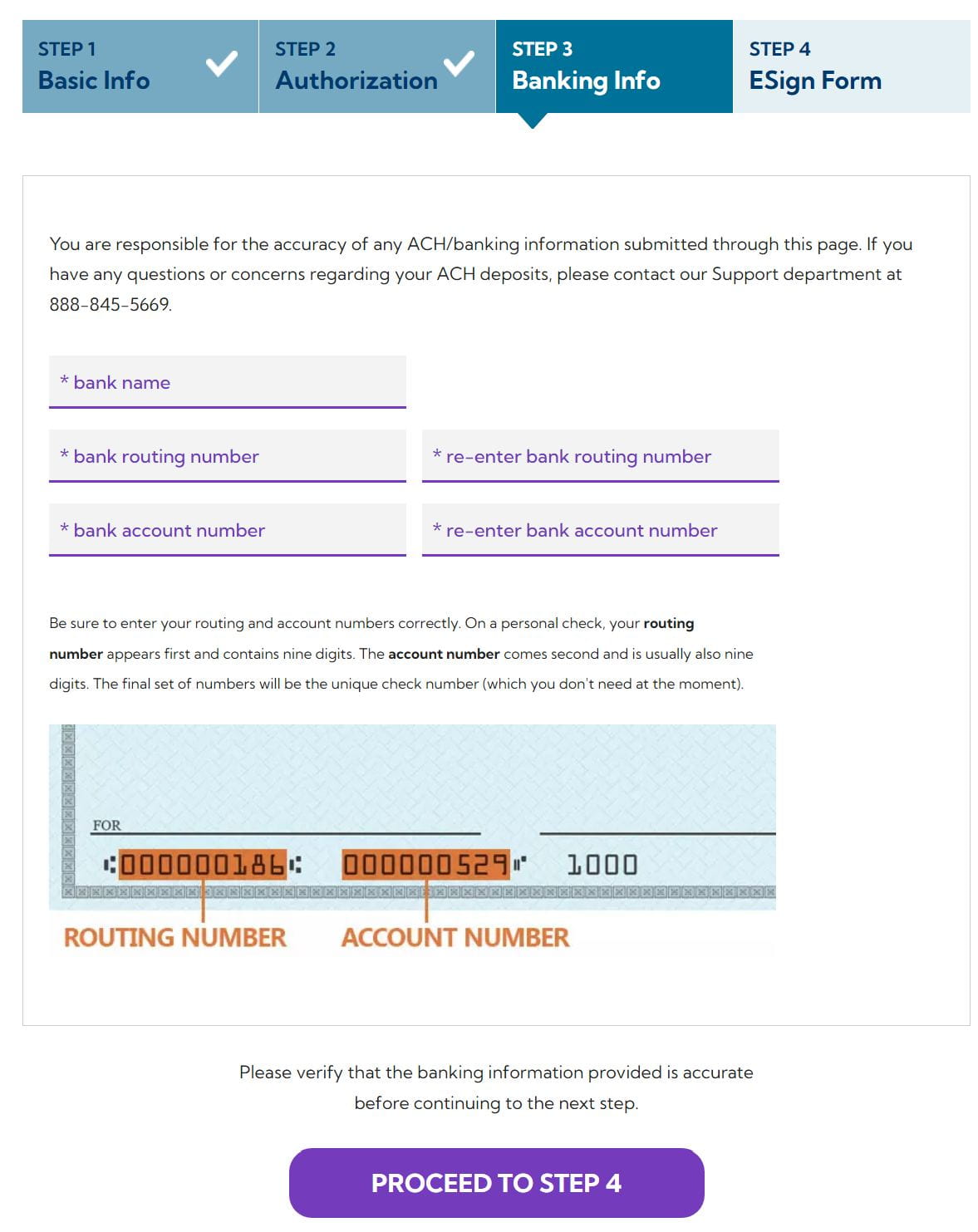

Step 3: Enter Banking Info

- Enter Bank Name

- Enter Bank routing number

- Re-enter Bank routing number

- Enter Bank account number

- Re-enter Bank account number

- Click PROCEED TO STEP 4

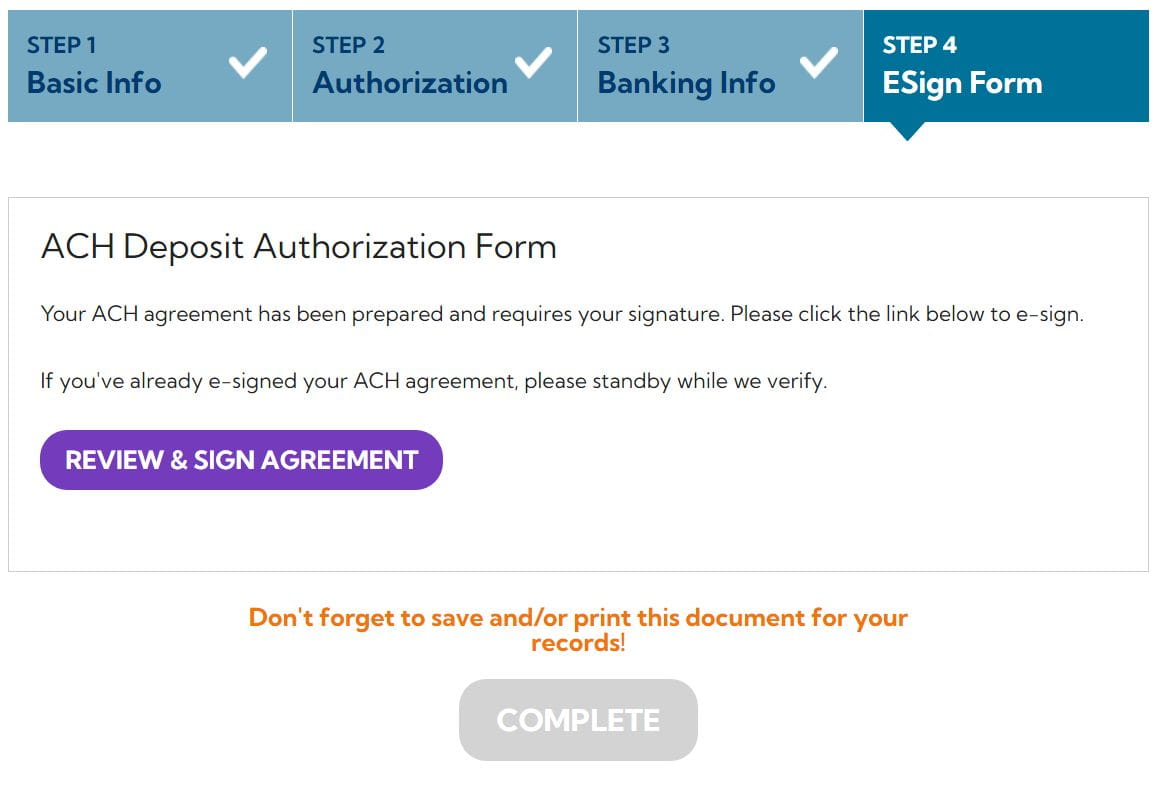

Step 4: Sign Agreement

-

Click "Review and Sign Agreement"

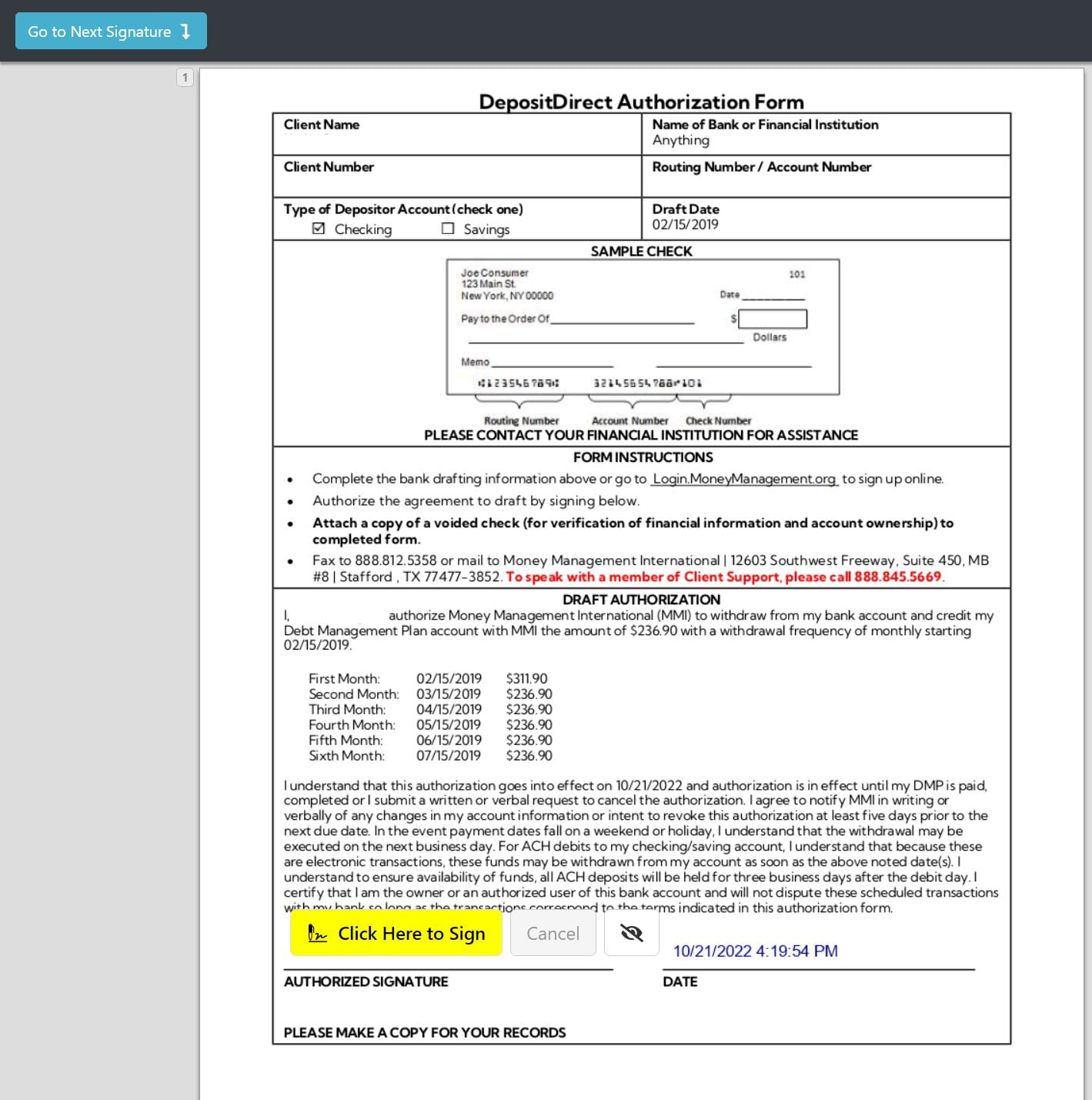

- Your agreement will open in a new browser

- Verify that the information is correct

- You can use the "Go to Next Signature" button at the top of the page to jump down to the signature line.

- Click the yellow signature box in order to sign the document

- After you've signed the document you’ll receive the following onscreen confirmation: The web document has been signed

- You'll be given the option to view and print the signed agreement

- It's a good idea to keep a copy of your signed documents for your records, but you'll also be able to access your signed documents through your MyMMI account any time you like.

- Close the browser window containing your signed agreement once you're finished.

- Click "Complete"

- This will bring you back to your MyMMI dashboard.