Instructions for Setting Up a New DMP

Starting a new debt management plan with MMI? Excellent! We're excited to work with you and help you become debt-free!

These instructions should help guide you through the process of creating an online account, digitally signing your documents, and setting up automated deposits.

What instructions do you need?

Create an Online Account and Register Your New DMP

Follow these steps to create a MyMMI account and connect it to your new DMP. This will give you online access to your DMP and allow you to sign your debt management agreement.

Navigate to the Registration Page

You can reach the registration page directly by clicking this link: moneymanagement.org/create-account

- The page can also be reached manually by clicking "LOG IN" in the upper righthand corner of any page on MoneyManagement.org:

- Once on the log in page, select "Create an account" to reach the registration page

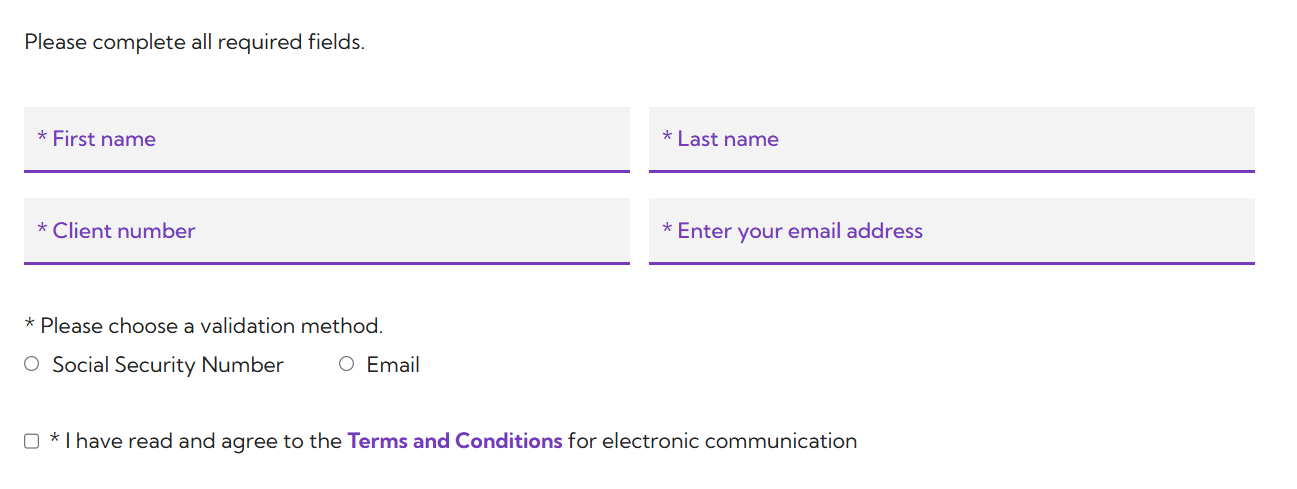

Step 1: Enter DMP Account Info

Provide the information requested in order for us to locate your new DMP in the system:

- Enter First name

- Enter Last name

- Enter your MMI Client number

- Enter your email address

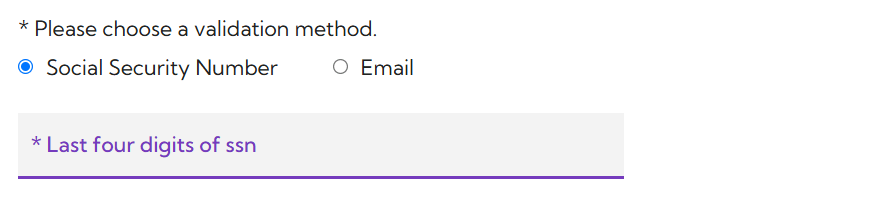

If you have a Social Security Number, click the radial button next to "Social Security Number" and you'll be asked to provide the last four digits of your SSN in order to validate your account.

If you don't have a Social Security Number, you can select the "Email" option and you'll later be given the opportunity to validate your account using your registered email address.

- Check the Terms and Conditions box

- Click PROCEED TO STEP 2

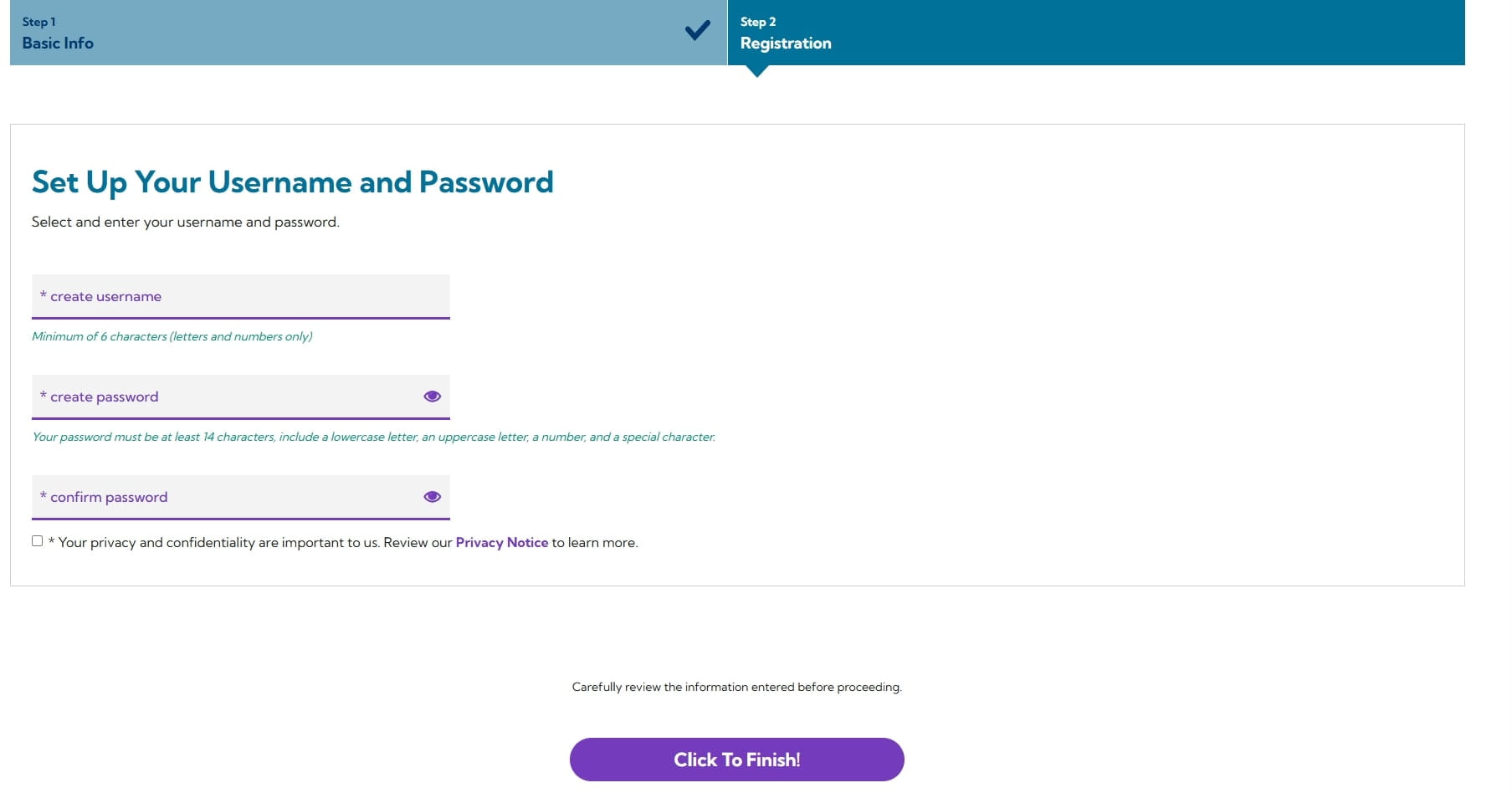

Step 2: Register Your Online Account

Fill out the fields in order to create your online account. Once your online account is registered and connected to your DMP, you'll be able to manage your DMP online any time you like.

- Begin by selecting a username and password:

- Your username:

- Cannot be an email address

- Must have a minimum of 6 characters

- Can only use letters and numbers (no special characters)

- Your password:

- Must be a minimum of 14 characters, including at least:

- 1 uppercase letter,

- 1 lowercase letter,

- 1 numerical value, and

- 1 of these special characters: ! @ # $ % ^ & * ( ) - _

- Must be a minimum of 14 characters, including at least:

NOTE: If you selected "Email" as the validation option in the prior step, you'll be prompted to verify your email address before proceeding.

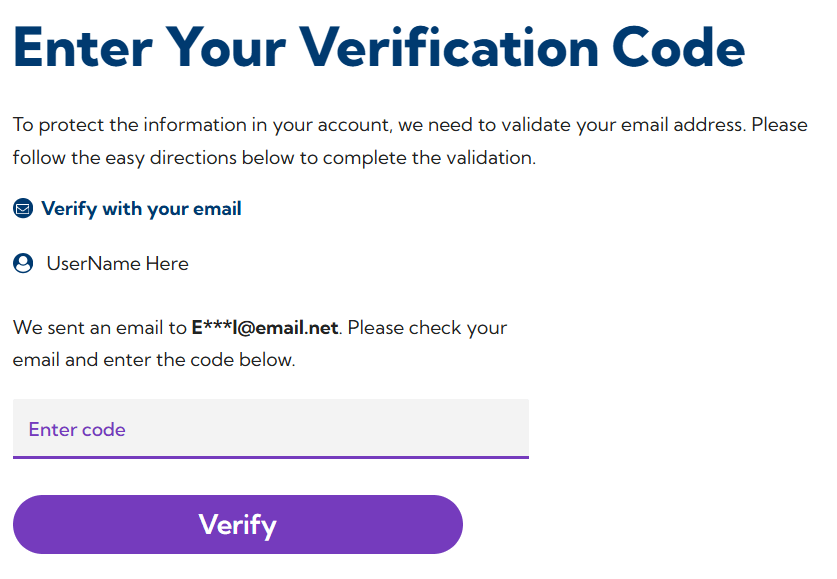

After clicking the "Verify email address" button, you'll be taken to a new screen:

Clicking "Send me an email" will trigger a verification code to be sent to your registered email address. Simply copy the code from that email and enter it where prompted:

Once you've entered the verification code, your email address will be verified and your DMP will be connected to your MyMMI online account,

You're not done quite yet, however. If you haven't already, we need you to sign your debt management agreement.

Reviewing & Signing your DMA

Before your DMP can begin, you need to review and sign your debt management agreement (DMA). Fortunately, now that you have a MyMMI account, you can easily read and sign your MMI documents online.

Step 1: Make Sure You're Logged In

Visit moneymanagement.org/login and use the username and password you created for yourself to log in to your MyMMI account.

Not able to use the direct link? You can reach the log in page from anywhere on MoneyManagement.org by clicking the "LOG IN" link in the upper right corner:

- If you have a co-client, they need to be present to sign at the same time as you.

Step 2: Locate and Open Your DMA

Once you're in your MyMMI account, your new documents will be available directly on the dashboard.

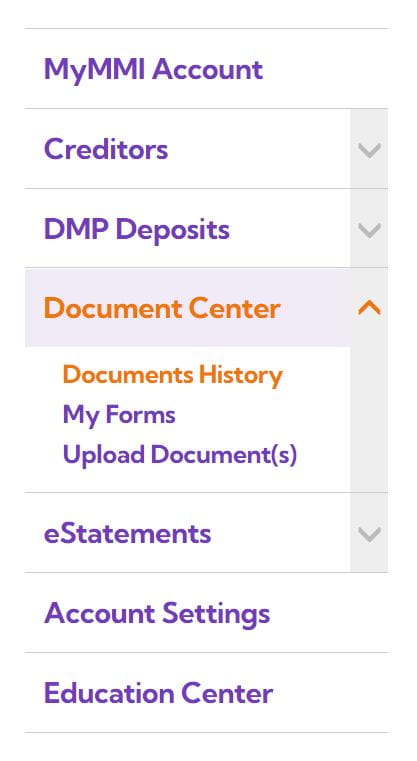

You can also locate documents in the Document Center:

- Locate your Debt Management Agreement from the list of available documents

- At the far right of the row, click the orange link that says click here to review and sign

- Your DMP agreement will appear in a new browser window

Step 3: Review and Sign Your DMA

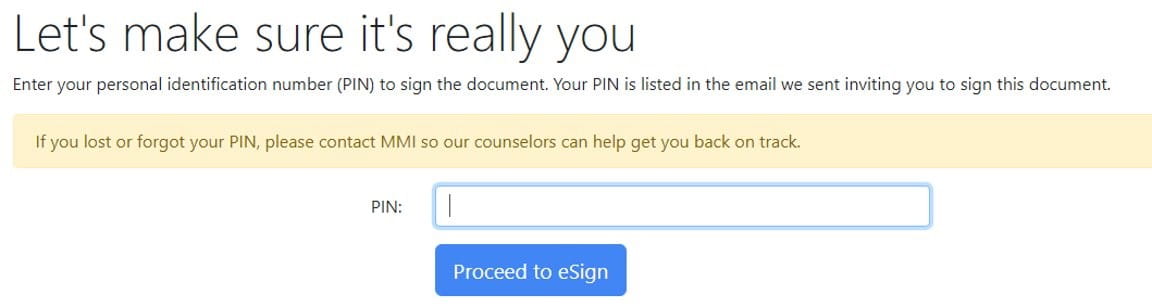

- Enter your PIN to access the document

- For security reasons, you'll be asked enter the PIN associated with your account. The PIN is listed on the email inviting you to sign the DMA.

- Review the agreement thoroughly

- Everything look good? Okay, let's sign your debt management agreement and get you started on your DMP!

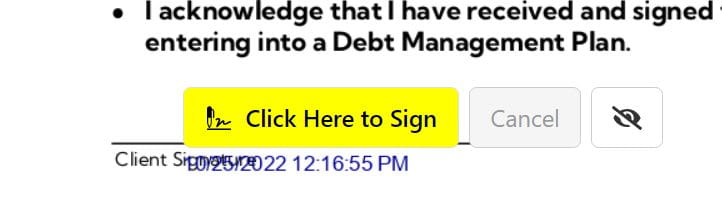

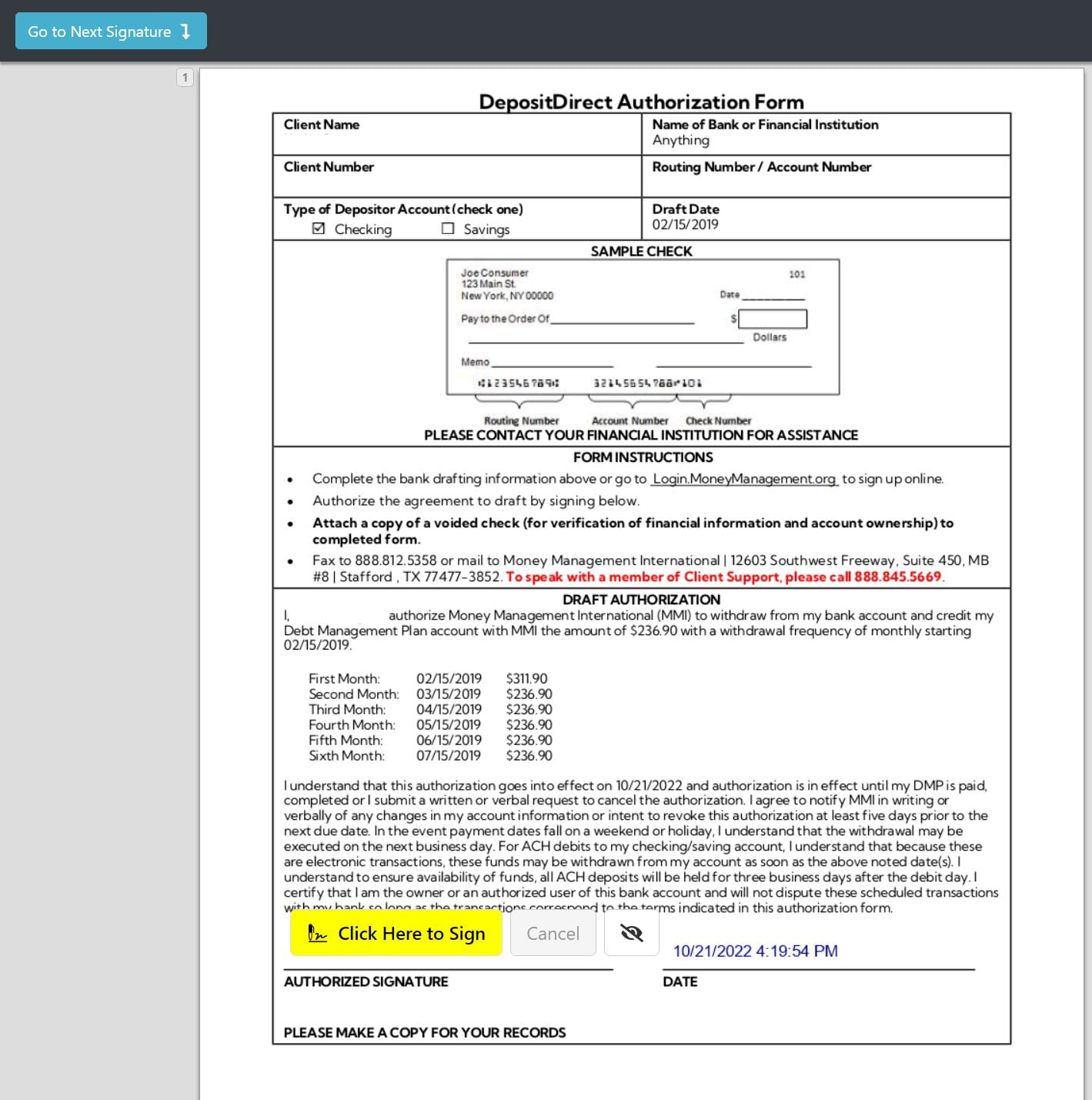

- Yellow signature boxes will appear as you scroll through the document - clicking these boxes will serve as your digital signature

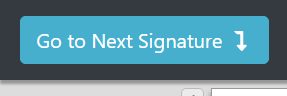

- You can use the "Go to Next Signature" button at the top of the page to navigate directly to each signature line

- Be sure to click each yellow signature box

- Special note: If there is a co-client on the DMP, once you complete the first set of online signatures, the document will loop back to the beginning so the co-client can also sign the DMP.

- When all yellow signature boxes have been clicked, you’ll receive this onscreen confirmation: The web document has been signed.

- You'll also be given the option to view and print your signed DMA

- It's a good idea to keep a copy of your signed DMA for your records, but you'll also be able to access your signed documents through your MyMMI account any time you like.

- You're done! Be sure to close only the browser window with your signed DMA. In many browsers you click an X in either the left or right corner of the window to close it.

Your debt management agreement is now signed! Once again, we're so glad to be able to help you improve your finances and your life.

While your DMA is signed, your debt management plan doesn't begin officially until you've made your first full month's deposit. With that in mind, let's finish the process and get you signed up for automated deposits.

Setting Up Automated Deposits

You aren't required to set up automated deposits as part of your debt management plan, but it's far and away the most popular choice for DMP clients. Automated deposits let you "set it and forget it", which helps to ensure that you don't miss any future creditor payments while on the DMP.

Log In and open the ACH Deposit Signup page

Visit moneymanagement.org/login and use the username and password you created for yourself to log in to your MyMMI account.

Not able to use the direct link? You can reach the log in page from anywhere on MoneyManagement.org by clicking the "LOG IN" link in the upper right corner:

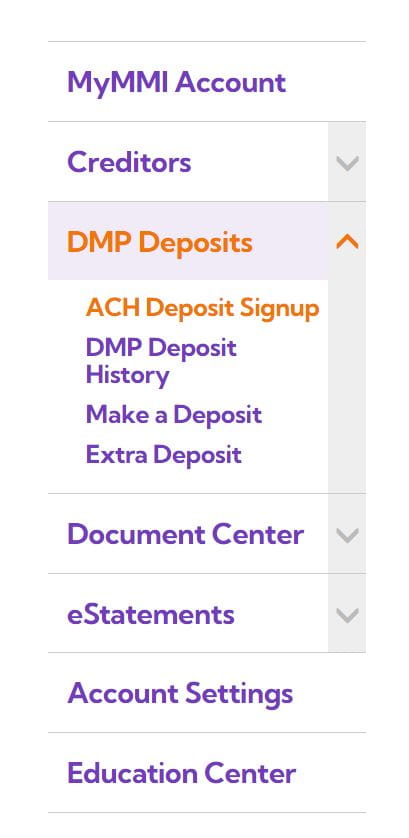

Open the DMP Deposit portion of the menu on the left side of the screen, then click "ACH Deposit Signup":

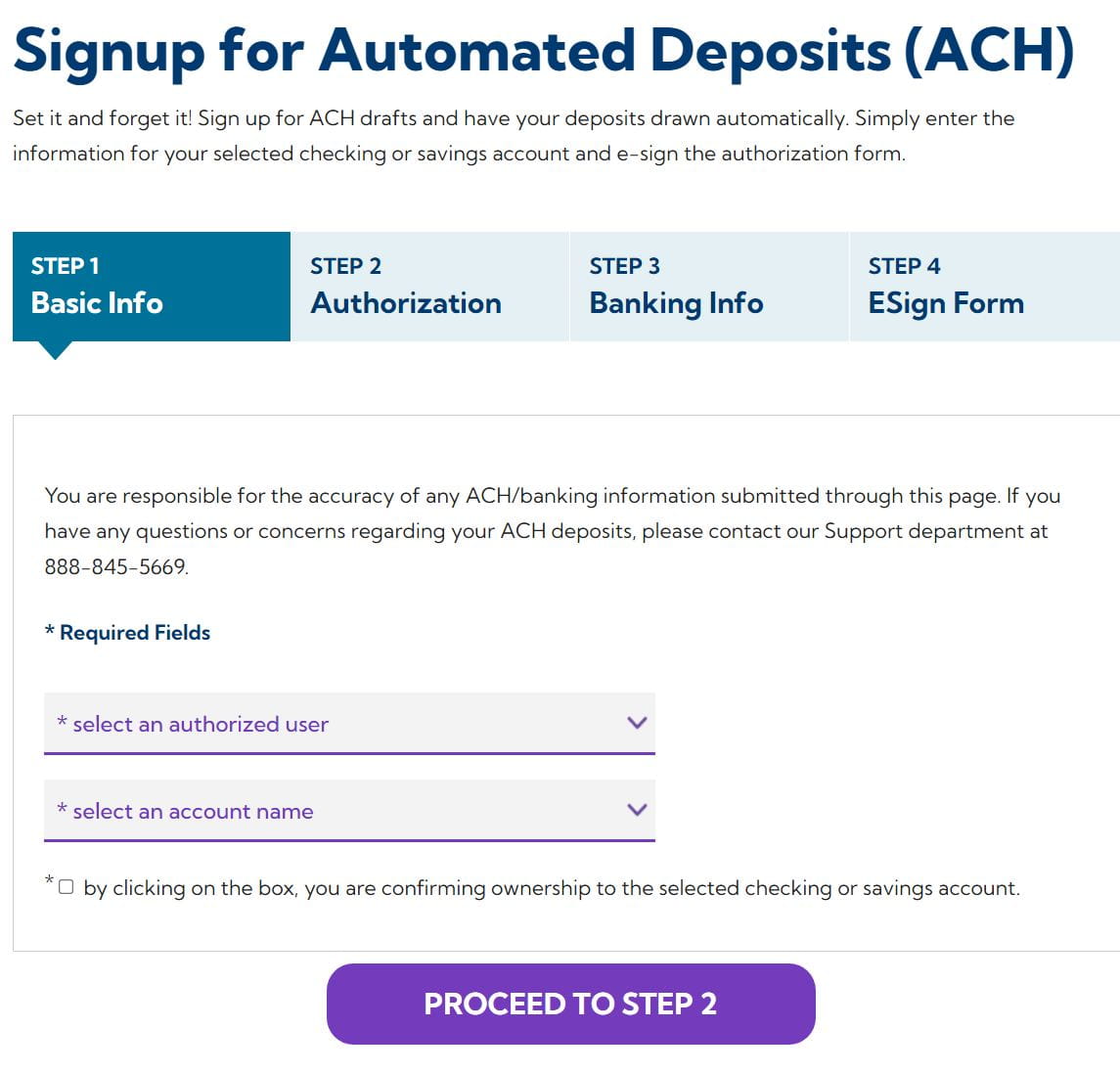

Step 1: Select the User and Account Type

- Select an authorized user

- Select an account name

- Click PROCEED TO STEP 2

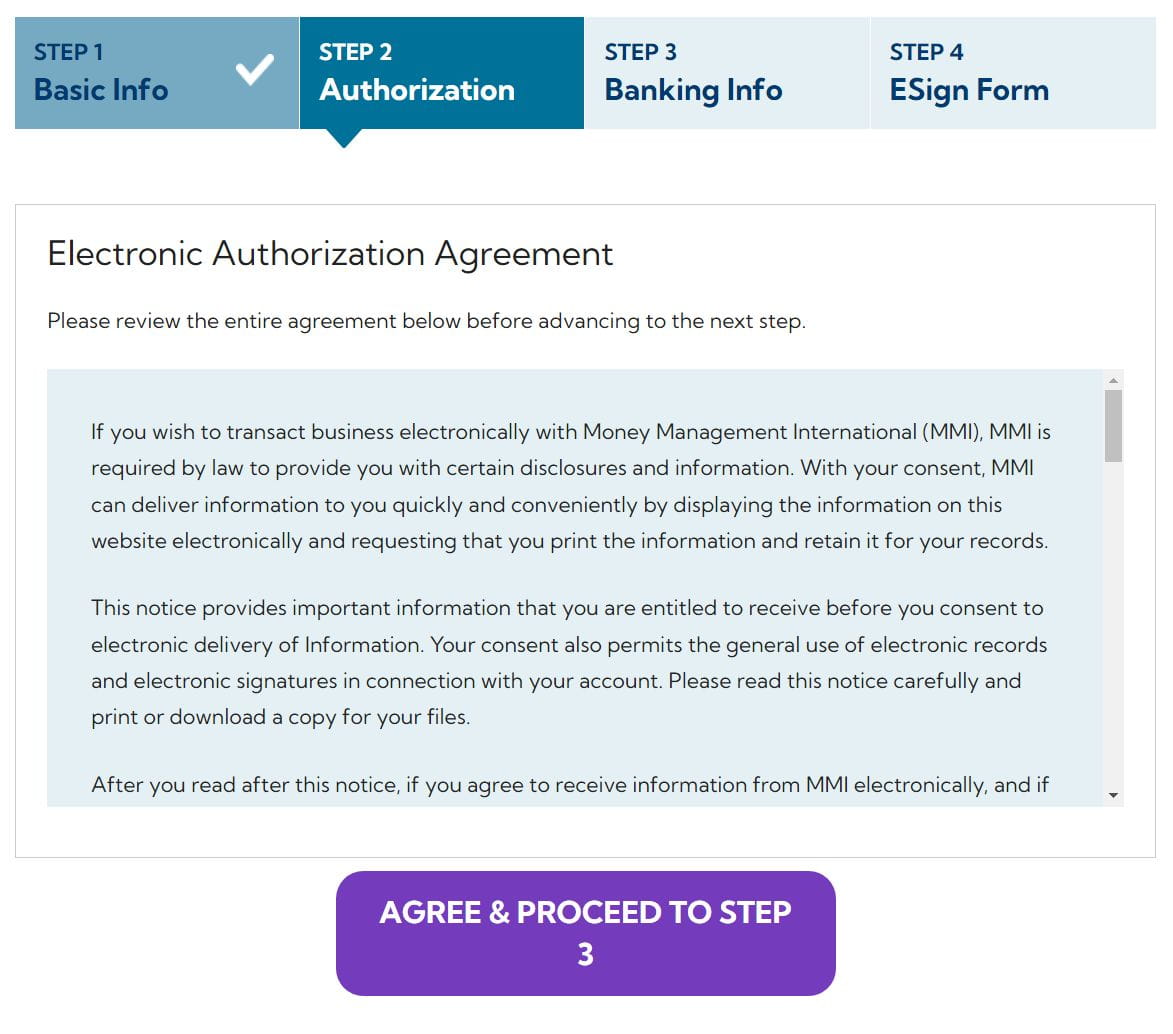

Step 2: Provide Authorization

- Review the authorization language

- Click AGREE AND PROCEED TO STEP 3

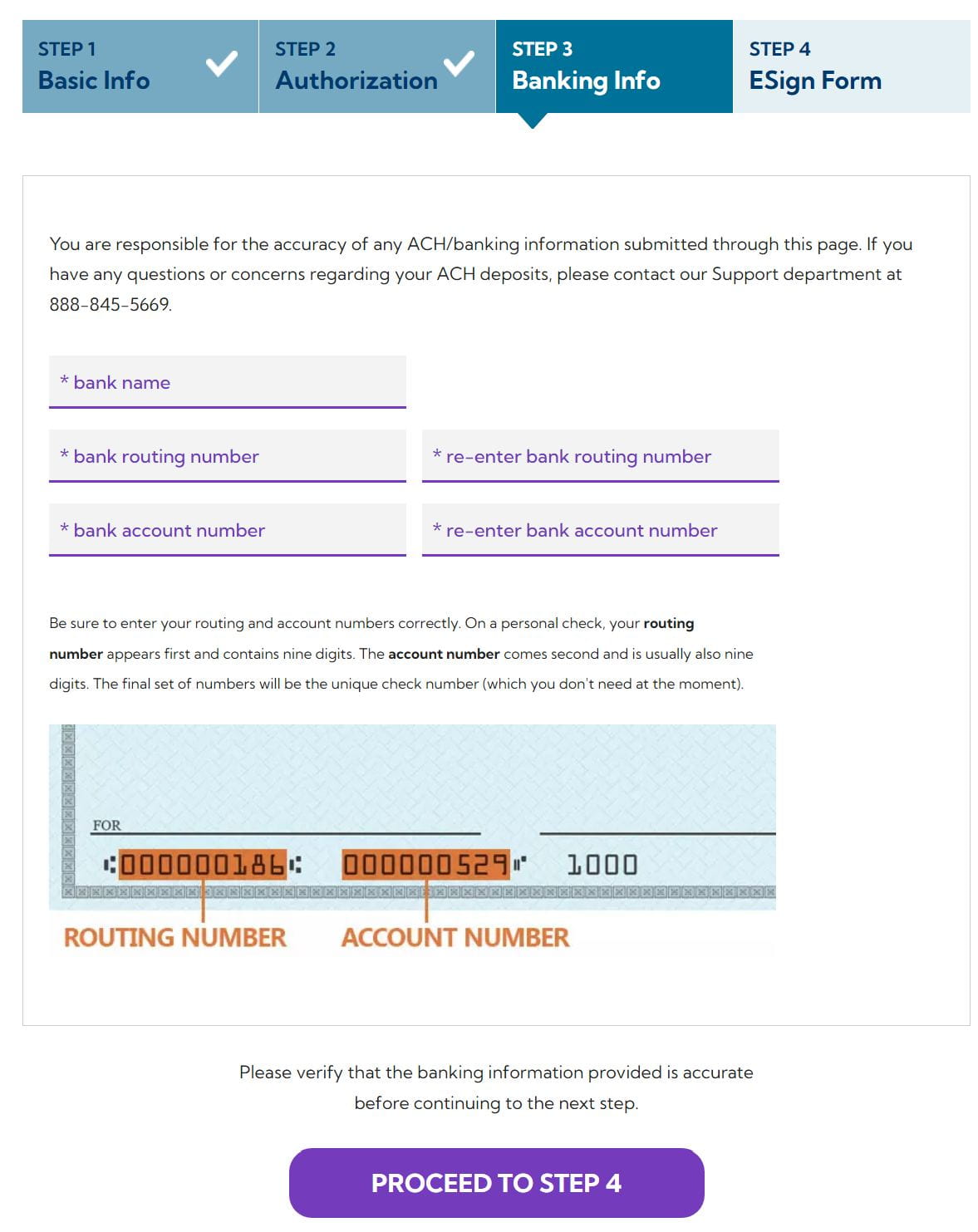

Step 3: Enter Banking Info

- Enter Bank Name

- Enter Bank routing number

- Re-enter Bank routing number

- Enter Bank account number

- Re-enter Bank account number

- Click PROCEED TO STEP 4

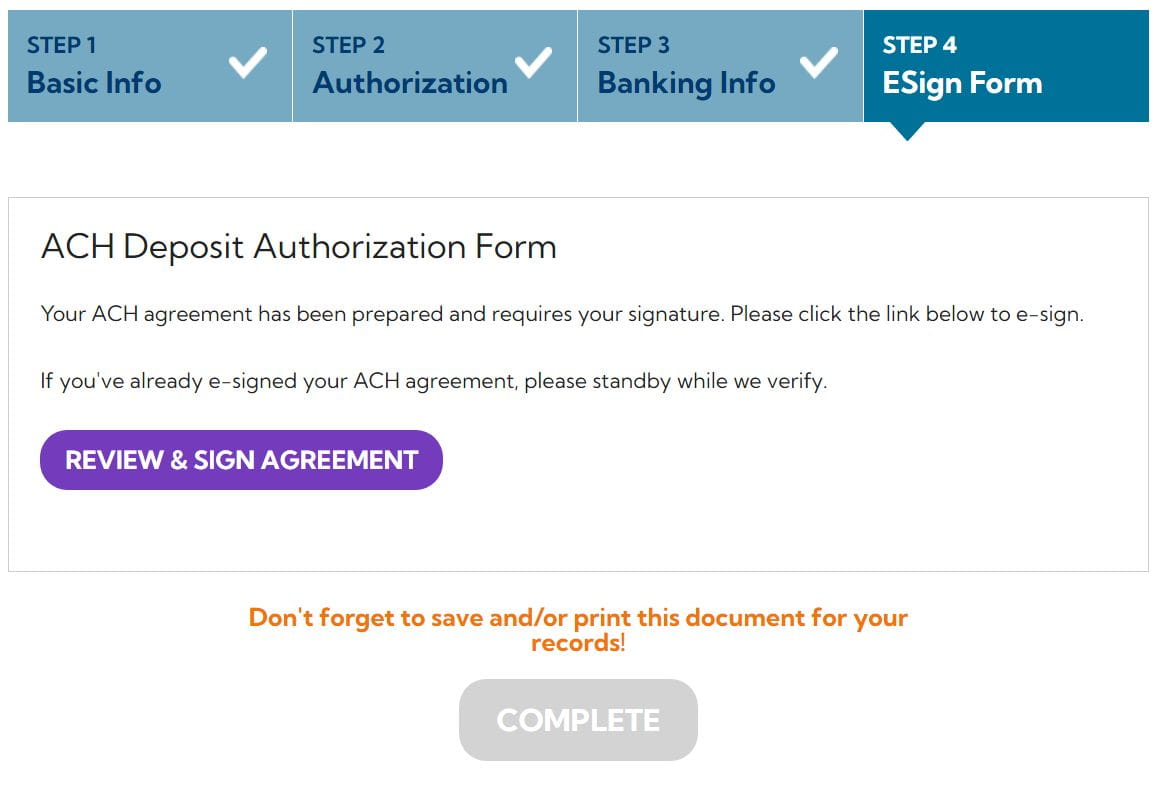

Step 4: Sign Agreement

-

Click "Review and Sign Agreement"

- Your agreement will open in a new browser

- Verify that the information is correct

- You can use the "Go to Next Signature" button at the top of the page to jump down to the signature line.

- Click the yellow signature box in order to sign the document

- After you've signed the document you’ll receive the following onscreen confirmation: The web document has been signed

- You'll be given the option to view and print the signed agreement

- It's a good idea to keep a copy of your signed documents for your records, but you'll also be able to access your signed documents through your MyMMI account any time you like.

- Close the browser window containing your signed agreement once you're finished.

- Click "Complete"

- This will bring you back to your MyMMI dashboard.